TOPICS

ENERGY TYPE

-

Sinopec Makes Breakthrough at Da-4 Risk Well in Junggar Basin

China Oil Exploration Sinopec 2025-12-09

-

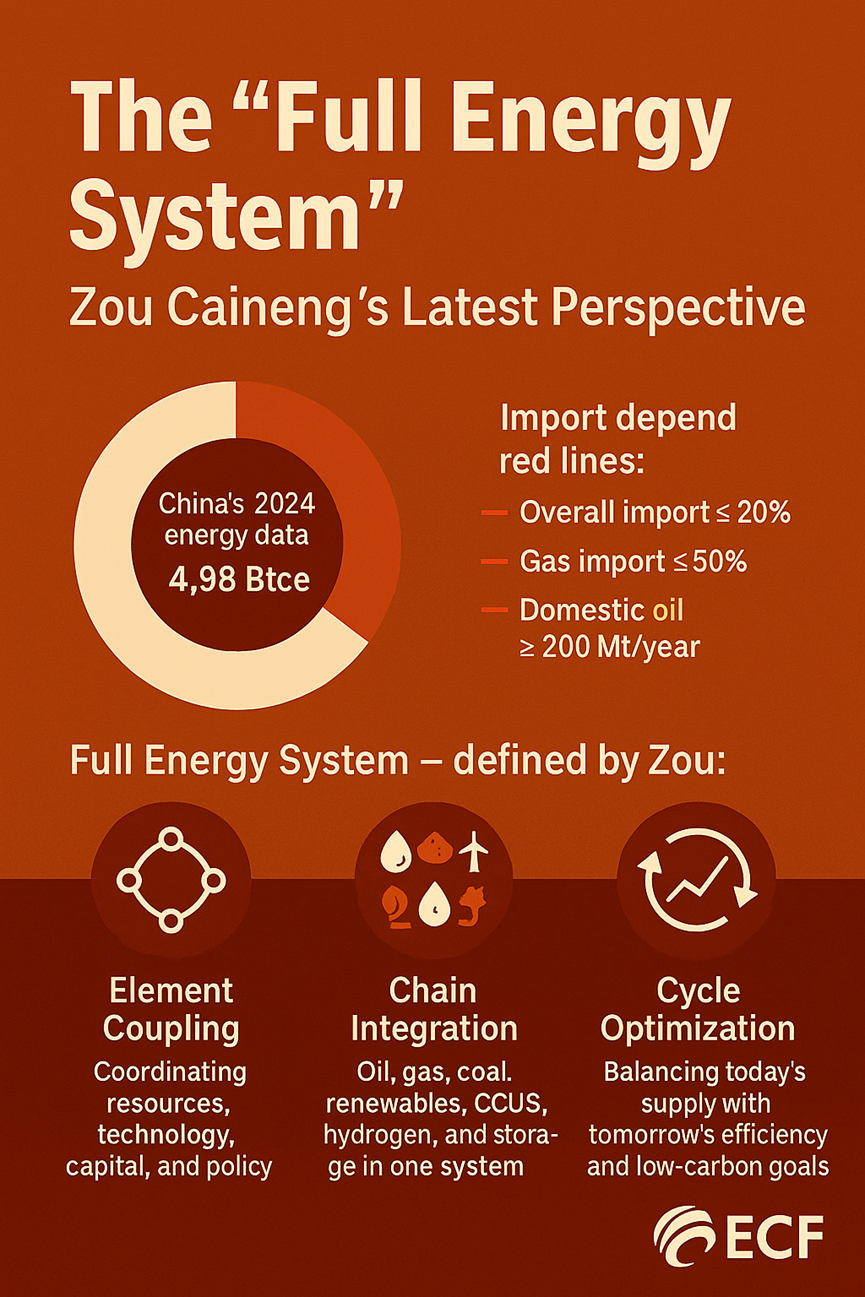

The "Full Energy System" — Zou Caineng's Latest Perspective

The "Full Energy System" — Zou Caineng's Latest Perspective

2025-09-15

-

Industry Trend: Unconventional Oil & Gas Is Moving Center Stage

Industry Trend: Unconventional Oil & Gas Is Moving Center Stage

2025-08-20

-

Smart Compilation, Carbon-Neutral, Well Testing | ECF Weekly

Smart Compilation, Carbon-Neutral, Well Testing | ECF Weekly

-

Call for Submissions: ECF Energy Technology Innovation Award 2025 Now Open!

Call for Submissions: ECF Energy Technology Innovation Award 2025 Now Open!

2025-07-29

-

【ECF Weekly】Surge in Share Buybacks Signals Strong Market Faith

【ECF Weekly】Surge in Share Buybacks Signals Strong Market Faith

2025-04-12

-

Signing of Major Central Enterprise Projects for Southwest Oil and Gas Fields

Global Market Cooperation 2025-02-18

-

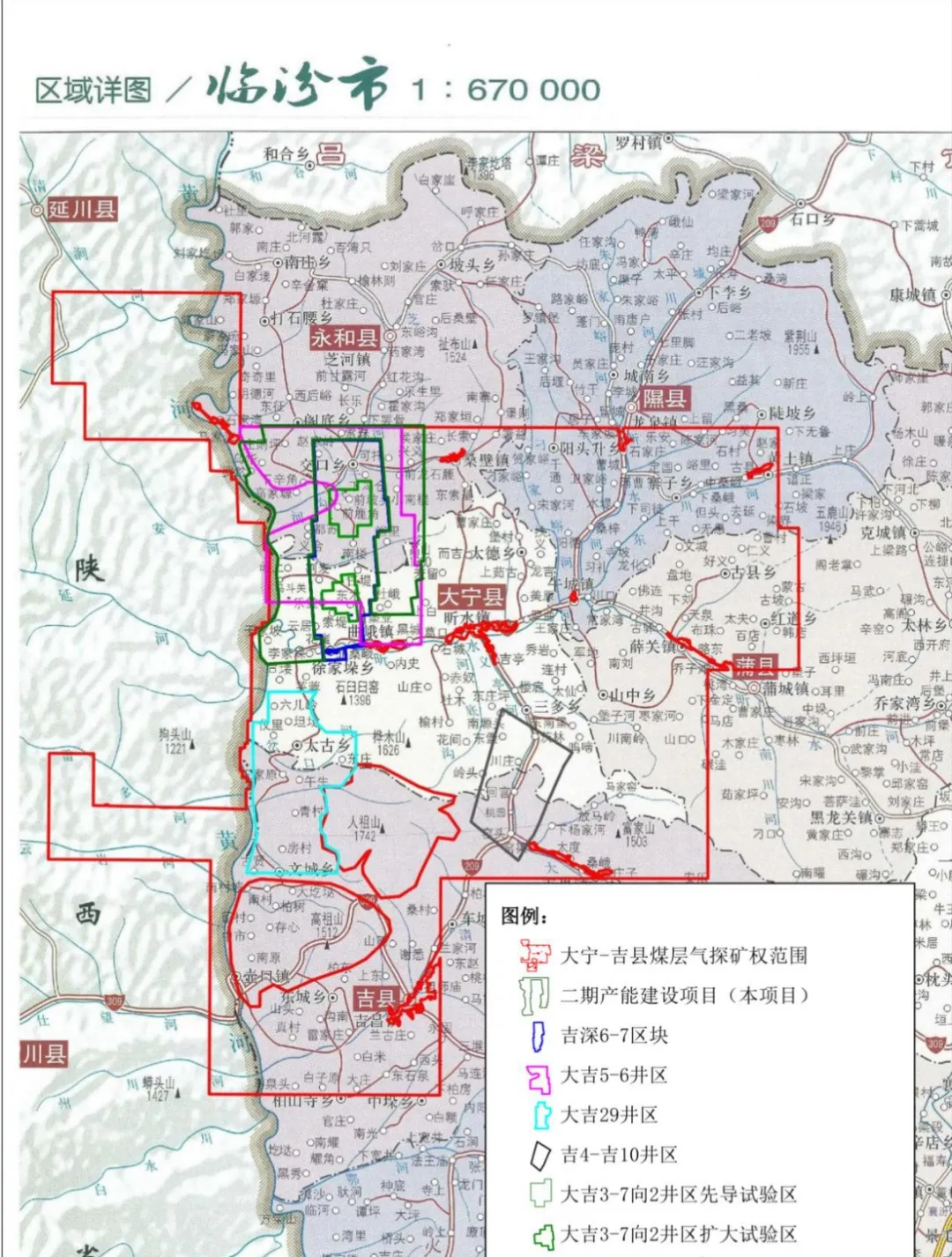

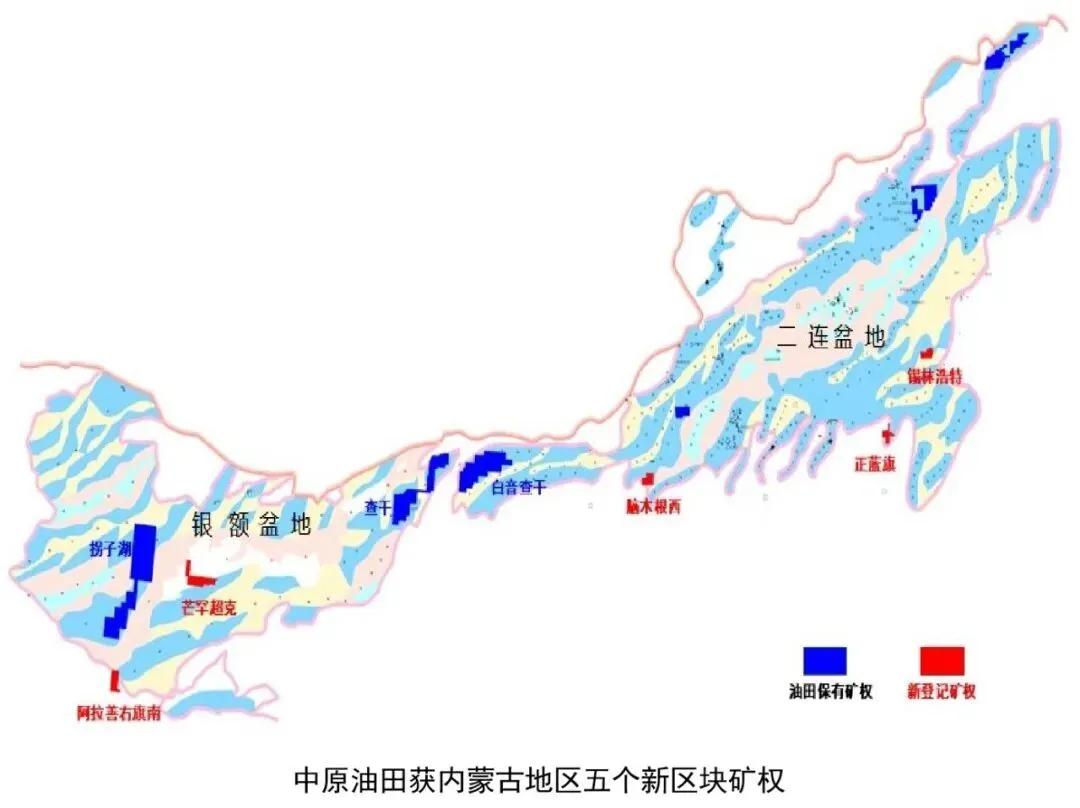

Inventory 2024: (Deep) Coalbed Methane Becomes an Industry Hotspot! Strong policy support!

ECF 2025-01-01

-

Nixon Corporation has been fully integrated into China National Offshore Oil Corporation (CNOOC) International Limited

Global Market 2024-09-20